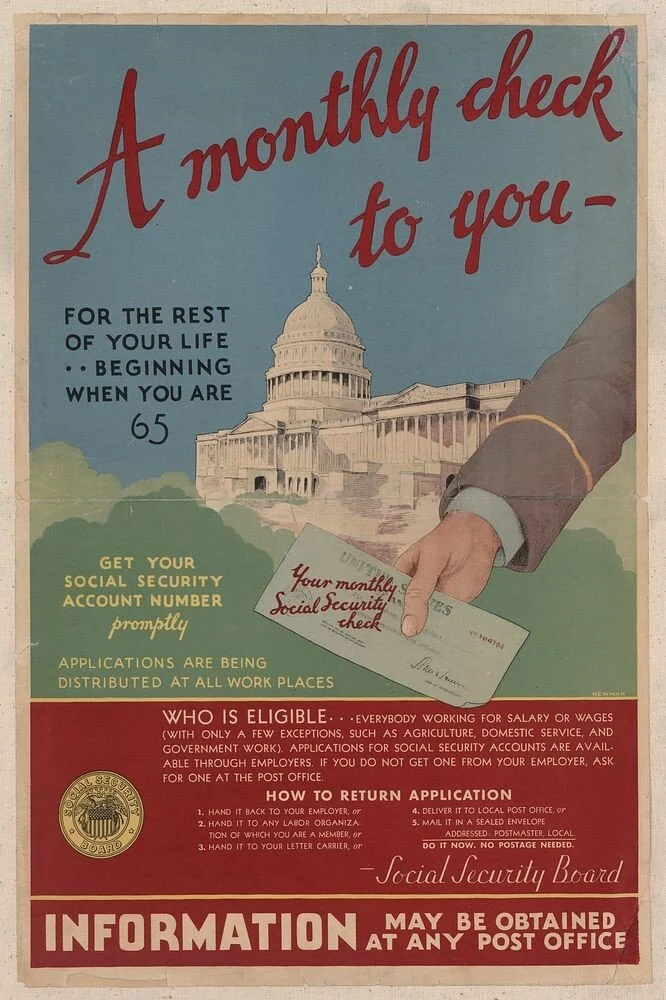

Today marks the 90th anniversary of the Social Security Act, signed into law on August 14, 1935, by President Franklin D. Roosevelt amid the economic devastation of the Great Depression. Formally known as Old-Age, Survivors, and Disability Insurance, the act established the foundation for America’s first permanent national old-age pension system, funded through payroll taxes collected from both employers and employees. It was part of Roosevelt’s broader New Deal—a series of reforms designed to bring relief and economic security to Americans struck by unemployment, poverty, and uncertainty following the stock market collapse of 1929.

The Social Security Act initially provided retirement benefits to Americans aged 65 and over, seeking to address the high rates of poverty among the elderly at the time. Over the decades, Congress expanded its provisions to cover dependents, people with disabilities, survivors of deceased workers, and various marginalized groups, further solidifying its role as a pillar of the nation’s safety net.

Today, nearly 69 million Americans each month—retirees, disabled workers, and families of deceased workers—depend on Social Security, with total annual benefits exceeding $1.6 trillion. For a significant proportion of older adults, Social Security is not simply supplemental income; it is a lifeline that helps American pay for basic necessities, including food, housing, and medicne.

Public confidence and support for Social Security remains exceptionally high: 96% of Americans view the program as important, and 74% rate it as one of the most important federal initiatives. This strong popularity is consistent across age groups and political affiliations, yet the program faces mounting financial pressure. According to the Social Security Administration’s latest report, the trust fund that supports retirement benefits is on track to be depleted by 2033—just eight years from now. If this occurs without Congressional action, benefits may face across-the-board cuts, jeopardizing the financial stability of millions of recipients.

A broad, bipartisan consensus has emerged around the preferred solution: most Americans do not want benefits reduced. Instead, 85% of those polled support raising payroll taxes—even if it means paying more themselves—to preserve and strengthen Social Security’s finances for current and future generations. Popular proposals include gradually increasing the payroll tax rate and eliminating the cap on taxable earnings, so that higher-income workers contribute a greater share.

The challenge is urgent. The population of seniors is projected to increase significantly over the next decade, ensuring that demand for the program—and the importance of sustainable funding—will only grow.

On this anniversary, as Social Security continues to deliver on its promise to millions, securing its future remains a defining test for American policymakers and society alike.

For further exploration of Social Security’s history, present status, and possible reforms, see these resources:

Historical Background and Development of Social Security - Social Security Administration

As Social Security Turns 90, It's Racing Towards Insolvency - Committee for a Responsible Federal Budget

Social Security at 90: A Bipartisan Roadmap for the Program’s Future - National Academy of Social Insurance