Starting a small business can seem overwhelming. There are many moving parts to consider throughout the process and it can be impossible to know where to start. The Harris County Robert W. Hainsworth Law Library has a plethora of resources that can help you with the legal side of starting and running a small business.

Read moreNational Entrepreneurship Month Resources

November is National Entrepreneurship Month. In a 2021 Presidential Proclamation, we are called upon to recognize the occasion with “appropriate programs and activities.” As a law library, our best contribution to that effort is to provide you, our reader, with information and resources that (1.) support the business operations of solo attorneys and (2.) help aspiring entrepreneurs start small businesses. This blog has featured many such resources over the last few years, which you can revisit here and here. Additional links are shared within.

Read moreFlying Solo: Resources for Starting Out and Keeping Up

Do you want to start your own private law practice but don’t know where or how to begin? The Harris County Robert W. Hainsworth Law Library can help! Provided in this blog post are links to several resources that will help you launch your own solo or small firm.

Read moreLatest & Greatest – Working for Yourself: Law & Taxes for Independent Contractors, Freelancers & Gig Workers of All Types

Are you looking for a career change? Perhaps, you are interested in lending your expertise to a company by working as an independent contractor or consultant. You wouldn’t be alone. A good percentage of the U.S. population is self-employed, meaning that they are working as independent contractors, consultants, entrepreneurs, and freelancers. The question then becomes: where do you begin? A good starting place is Nolo’s Working for Yourself: Law & Taxes for Independent Contractors, Freelancers & Gig Workers of All Types, the newest book to join the Law Library’s Self-Help Collection.

Working for Yourself includes necessary current legal and tax basics to assist you on your road to becoming your own boss. Topics include:

choosing the type of business entity;

obtaining business licenses, employer identification numbers, and sales tax permits;

insuring your business;

pricing services and getting paid;

paying taxes and keeping track of expenses; and

preparing written client agreements.

You can also find updates and changes made to the Tax Cuts and Jobs Act that are beneficial to those who are self-employed. In other words, Working for Yourself has the pertinent information you need to get yourself started on the road to self-employment.

Other books by Nolo in the Law Library’s collection that you might find to be of interest include: Legal Forms for Starting and Running a Small Business and the Small Business Start-Up Kit.

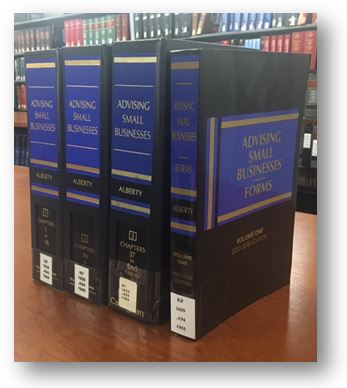

Latest & Greatest – Advising Small Businesses

It’s Small Business Resource Month here at the Harris County Law Library. Today, we’re looking at one of the featured resources: the aptly titled, Advising Small Businesses by Steven C. Alberty. Written for lawyers who represent and counsel small businesses, Advising Small Businesses, offers practical information on all aspects of small businesses from their organization through their operation and ultimately their termination. Detailed and exhaustive, this three-volume treatise offers its readers a thorough analysis of the following topics:

- Choice of entity, including the advantages and disadvantages of each and the tax implications arising from each type of entity;

- Available financing options, such as debt financing, government financing, and venture capital financing;

- Applicable state and federal securities laws;

- Corporate operations, including shareholder voting, buy-sell agreements, and powers, duties, and liabilities of corporate directors and officers;

- Business transactions, such as insurance coverage, antitrust laws, franchising, and intellectual property;

- Employee relations and compensation; and,

- Dissolution and liquidation.

As a companion to this treatise, the Harris County Law Library also has in its collection, Advising Small Businesses: Forms. This indispensable set provides attorneys with practical tools in the shape of “ready-to-use” forms and checklists, which include sample letters, operating agreements, employment policies, and closing documents.

If you an attorney who owns, operates, manages, or advises small businesses, we hope you’ll find this resource helpful. For additional resources that you can find here at the Law Library and online, visit our Events page.